Frauds are everywhere. We are so used to news of financial crimes that it doesn’t bother most people. But you could be a victim any day. It’s a rampant crime that we often downplay.

In 2021, there were more than 88000 reports of credit card fraud and nearly 70000 frauds from payment apps and services.

There were, somewhat surprisingly, 12000 crimes involving cash and 8000 involving checks. These numbers, when combined, are even scarier.

In 2021, the total amount of money involved in scams and fraudulent activities was $5.8 billion.

That’s how big of a threat this is.

Technology birthed an entirely new breed of financial crimes. Technology is also giving us ways to protect ourselves from these crimes. When you combine tech literacy, anti-fraud tools, and common sense, you get a potent antidote to fraudulent activities.

The role of technology in frauds

In this article, we will look at how technology can help you stay protected from financial crimes and fraudulent activities.

We’ll also talk about fundamental tech literacy since most of the victims are unaware of how frauds work. The more educated you are, the safer you are.

Types of financial frauds

First, let’s define what fraud is. When one or more people tries to intentionally mislead and misdirect someone with the intention of deceptively taking money, we call it fraud. There are several forms in which the money could be taken, not necessarily in cash alone.

There are broadly two types of frauds — online fraud and offline/physical fraud. For our purpose, we will only talk about online fraud.

Here are the most common types of financial fraudulent activities.

Identity theft

To put it in simple words, identity theft means someone is impersonating someone else to make purchases or move money on their behalf. When a cybercriminal gets access to your credit card information, they can pretend to be you to transfer money and buy things. Identity theft is by far the most common type of fraud.

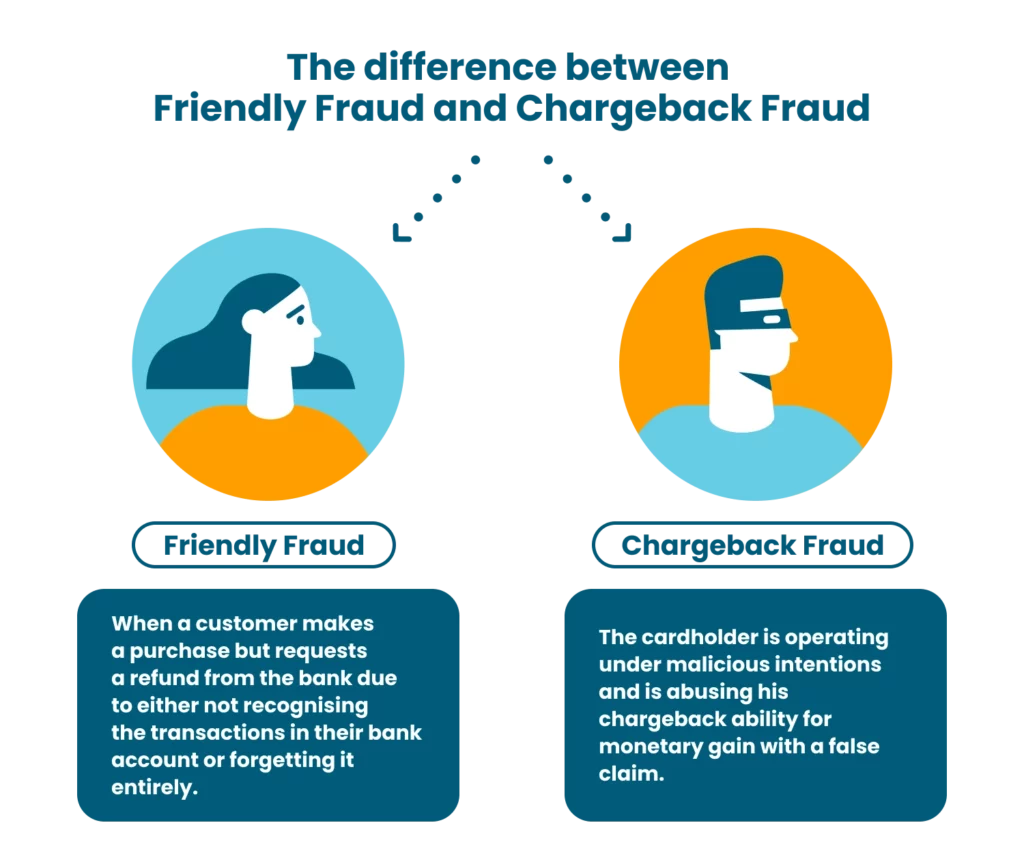

Chargeback fraud

In chargeback fraud, the bank or the merchant is the victim, and the buyer is the perpetrator. Buyers first make a purchase using their credit card. Once the purchase is complete, they report that their card has been stolen and they did not make any purchase. Then the bank or the merchant has to give a refund. This is also known as friendly fraud.

Fortunately, chargeback fraud prevention is possible with the right tools and software. It’s a necessary component for all businesses that have an online shop. While chargeback fraud does not concern buyers, sellers and lending institutions have to be on their guard at all times.

Merchant fraud

Merchant fraud is a rather direct type of fraud that you can avoid by being vigilant. In merchant fraud, the merchant takes orders and receives payments with the promise of delivering an item, but then disappears with the money. It’s a common form of financial fraud in the offline world as well.

Cybercriminals often use spoof websites to carry out merchant fraud. A spoof website looks exactly like an original online shopping website but steals your credit card and other sensitive information. For instance, you may buy something from a website that looks exactly like Amazon but is actually a spoof website. You can stay from spoof websites by not clicking on ads and popups and always checking website URLs.

Pyramid schemes

Pyramid schemes promise amazing returns but end up fleeing with the investors’ money. Pyramid schemes do not fall under the category of online fraud, but are often carried out digitally.

There are numerous tools you can use to not fall for pyramid schemes. Google alone will give you information about a certain scheme or fund. As long as you are aware and vigilant, you don’t need to worry about pyramid schemes.

Can technology end fraud?

Technology alone cannot end fraud. No matter how efficient a tool is, you also need to be competent enough to use it. Otherwise, it’d be useless. Technology combined with awareness and common sense can prevent fraud even if it can’t end it.

Fraudulent activities are as old as civilization itself. There’s no way we can end it, but the best we can do is to keep ourselves safe.

How to use technology to prevent fraud?

There are many ways you can prevent fraud, with or without technology. But in some cases, you need a strong technology-based anti-fraud framework to stay protected.

How you adopt technology to prevent fraud also depends on whether you are primarily a buyer or seller. Many of us fall in both categories, but more in one than the other. For business owners, it’s crucial to use the right anti-fraud tools and software.

Here are some ways you can use technology to prevent fraud:

Use anti-fraud software

Anti-fraud software comes in different types and abilities. While some target specific areas like chargeback fraud, others provide comprehensive security for a business. If you run a business, you cannot overlook the importance of anti-fraud software.

When choosing from different anti-fraud tools, make sure you keep in mind the potential growth of your business. What suffices today may not suffice tomorrow, and that makes scalability an essential feature. Apart from that, the cost is an obvious factor.

However, it’s worth spending a few more bucks to save yourself from a scam that can leave you bankrupt.

If you are primarily a buyer, you may not need to worry about anti-fraud software. Nonetheless, you can still use some elements from them to better protect your finances. For example, you can use databases to check the legitimacy of a financial scheme you are thinking about investing in.

Cloud security

In 2022, many of us have sensitive information stored on the cloud, for both individuals and businesses. It’s important for everyone to put special attention to cloud security, especially if you use cloud-based services all the time.

Cybersecurity tools do a good job of providing real-time cloud security. Even if you only order things from shopping websites occasionally, it’s wise to invest in a cyber protection tool that’ll help you secure cloud data. For businesses, cloud security often comes as a part of a comprehensive anti-fraud software suite.

Secure your credit cards

We often store our credit card information with shopping websites for convenience and fast checkouts. If you are keen on doing it, make sure the shopping website in question is not dubious. It’s best to store credit card information only with the websites you use frequently.

There’s another way to store credit card information with much lower risk. The trick is to use password managers. These tools and apps add several layers of security to make it virtually impossible for cybercriminals to access your credit card information. At the same time, you can conveniently pull the details from the manager for quick purchases.

Password managers

Password managers now offer credit card storage facilities, but they were originally designed to store login passwords and usernames. Apart from being extremely convenient, password managers are also far safer than manually storing your passwords.

Password managers not only store your passwords safely but also suggest strong passwords. Large databases of passwords and usernames are often leaked in data breaches. If you use the same or similar password across platforms, it’s very easy for hackers to get your passwords. By generating a strong and random password, password managers keep you protected from data breaches.

Customer profiling and background checks

If you are in the B2B space or involved in a lending business, you would always want to know if your clients are reliable. In the past, you would have to depend on sparse information and word-of-mouth to determine a person’s legitimacy. Now banks are using machine learning technologies to scan huge databases and detect suspicious activities.

Several SaaS security tools help small businesses and lenders scan potential clients for reliability and authenticity. If you are using these tools, you are at a much lower risk of getting duped.

General practices for online safety

There are a few general principles that everyone should keep in mind to be safer online:

- Never respond to suspicious emails, SMS, or calls. Remember that banks would never call you and demand sensitive information

- Never click on pop-up ads, especially on shady websites

- Always make sure you are using the official website and/or app of an eCommerce website

- Never give credit card pins to anyone

- Use anti-virus software on your personal computer

- Do not shop online from public networks (cafes, malls, etc.)

- Use two-factor authentication wherever possible

- If you lose money to fraud, report it to the authorities at the earliest as it increases the chances of retrieving the amount

Conclusion

Following the basic rules of internet safety can keep you and your money safe.

When you combine the right tools and software, your chances of being a victim reduce drastically.

We hope we have raised some important points about preventing fraudulent activities. The more you know about these frauds, the better equipped you can be.